A portal website bringing together vital information about natural gas and natural gas vehicles.

| [maxbutton id="1"] | [maxbutton id="2"] |

| . | |

| [maxbutton id="7"] | [maxbutton id="3"] |

| [maxbutton id="6"] | [maxbutton id="5"] |

| . | |

| [maxbutton id="4"] | [maxbutton id="11"] |

| [maxbutton id="13"] | [maxbutton id="14"] |

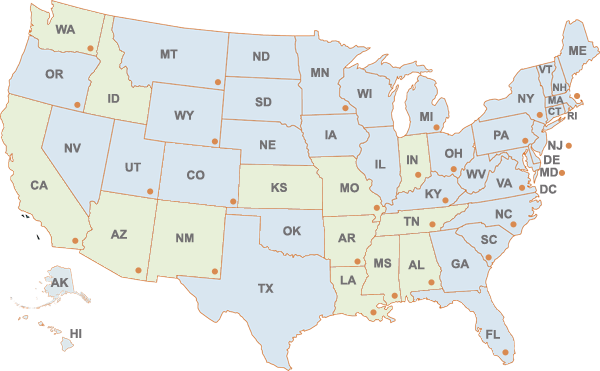

Hover mouse over state for fuel tax info; click each state for full details.

States in Green require an annual fuel tax decal for alternative fuels

States with orange dots have downloadable Profile Sheets - click the state to access Profile Sheet. (More Info)