A portal website bringing together vital information about natural gas and natural gas vehicles.

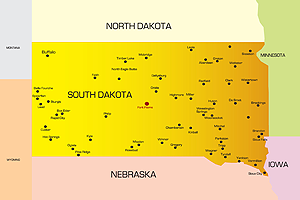

| South Dakota is still in early stages of AFV adoption. The states main focus has been on ethanol and biodiesel, with no natural gas stations in the state, and few listed vehicles as of 2016. The state has passed a tax law encompassing taxes on CNG and in 2014, LNG. The 2012 legislative session brought about a law that creates technology parks for the research and development of alternative fuel technology. |

| Legislative Session Dates: | January 14 - March 31 |

| Legislature Website: | http://legis.sd.gov/ |

This state was last examined and updated in December, 2016.